Business Insurance in and around San Jose

One of the top small business insurance companies in San Jose, and beyond.

Almost 100 years of helping small businesses

- San Jose

- Santa Clara County

- Bay Area

- California

- Northern California

- Southern California

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide great insurance for your business. Your policy can include options such as extra liability coverage, a surety or fidelity bond, and business continuity plans.

One of the top small business insurance companies in San Jose, and beyond.

Almost 100 years of helping small businesses

Get Down To Business With State Farm

Whether you own a HVAC company, a home cleaning service or a dry cleaner, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Art Holland is here to review your business insurance options with you. Call or email Art Holland today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

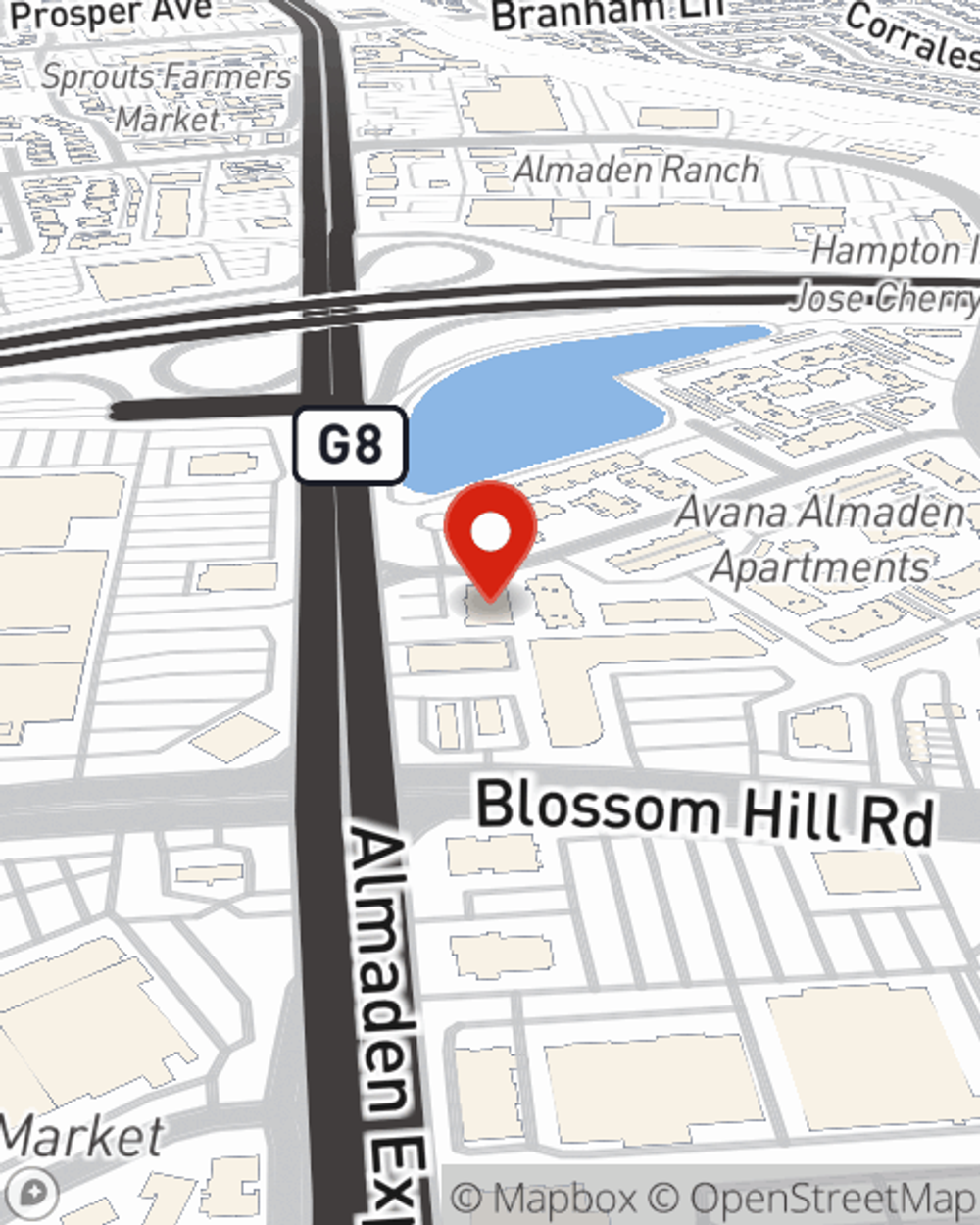

Art Holland

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.